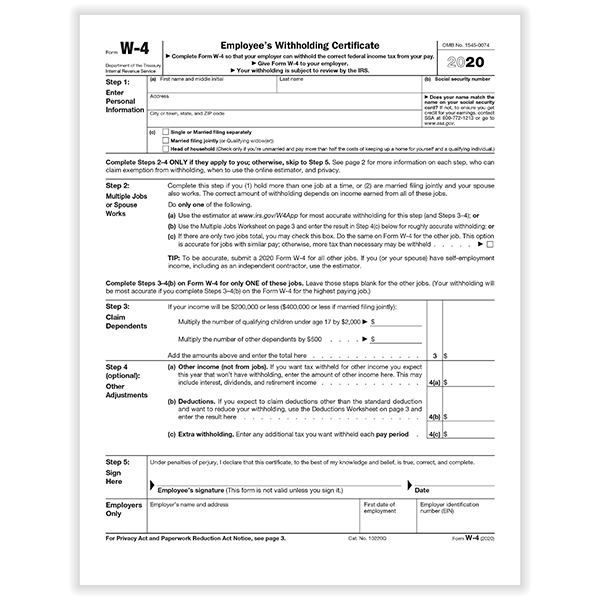

Īn individual is considered a resident of the United States for tax purposes if he or she is a citizen of the United States or a resident alien of the United States for tax purposes. The corresponding main form filed by businesses is Form 1120, also called the U.S. 9.3 Changes to complexity and tax ratesįiling requirements Who must file? įorm 1040 (or a variant thereof) is the main tax form filed by individuals who are deemed residents of the United States for tax purposes.9.1 Original form structure and tax rates.Altogether, 142 million individual income tax returns were filed for the tax year 2018 (filing season 2019), 92% of which were filed electronically. On the right side of the first page is the presidential election campaign fund checkoff, which allows individuals to designate that the federal government give $3 of the tax it receives to the Presidential election campaign fund. The second page reports income, calculates the allowable deductions and credits, figures the tax due given adjusted income, and applies funds already withheld from wages or estimated payments made towards the tax liability. In particular, the taxpayer specifies his/her filing status on this page. The first page collects information about the taxpayer(s) and dependents. An automatic extension until October 15 to file Form 1040 can be obtained by filing Form 4868.įorm 1040 consists of two pages (23 lines in total) not counting attachments. In those circumstances, the returns are due on the next business day. Income tax returns for individual calendar year taxpayers are due by Tax Day, which is usually April 15 of the next year, except when April 15 falls on a Saturday, Sunday, or a legal holiday. The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government. Individual Income Tax Return") is an IRS tax form used for personal federal income tax returns filed by United States residents. 653 IRS Notices and Bills, Penalties, and Interest Charges." Accessed July 8, 2020.Form 1040 (officially, the "U.S. "IRS E-File Frequently Asked Questions,". "Extension of Time to File Your Tax Return." Accessed July 8, 2020. "General Instructions for Certain Information Returns (2020)," Pages 26-28. 31 Filing Deadline for Employers, Other Businesses to File Wage Statements, Independent Contractor Forms." Accessed July 8, 2020. 456 Student Loan Interest Deduction." Accessed July 8, 2020. "About Form 1099-MISC, Miscellaneous Income." Accessed July 8, 2020. "IRS Opens 2020 Filing Season for Individual Filers on Jan. "Electronic Filing Options for Individuals." Accessed July 8, 2020. "Can I File an Amended Form 1040-X Electronically?" Accessed July 8, 2020.

"Form 8948: Preparer Explanation for Not Filing Electronically,". "H&R Block Digital Tax Preparation, Online, and Mobile Application Privacy Practices and Principles,". "Schedules for Form 1040 and Form 1040-SR." Accessed July 8, 2020. 301 When, How, and Where to File." Accessed July 8, 2020.

SHOULD TAX FORMS BE STAPLED FREE

"Line-by-Line Help Free File Fillable Forms." Accessed July 8, 2020. Tax Return for Seniors." Accessed July 8, 2020. "Publication 17: Tax Guide 2018 for Individuals,". "Affordable Care Act Tax Provisions." Accessed July 8, 2020. "Publication 5307, Tax Reform: Basics for Individuals and Families." Accessed July 8, 2020.

SHOULD TAX FORMS BE STAPLED HOW TO

IRS: How to Prepare Your Tax Return For Mailing.IRS: Publication 17 - Your Federal Income Tax: Attachments.

0 kommentar(er)

0 kommentar(er)